Help ensure the future of music by including New England Conservatory in your estate plans.

By supporting NEC with a planned gift, such as through a bequest or a charitable trust, you are ensuring NEC’s leadership and impact in the world of music and for the world through music.

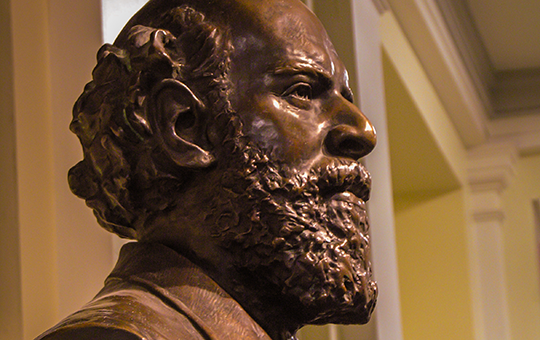

Tourjée Society

Join the Tourjée Society for exclusive NEC updates and invitation to events! Share your intention or other type of planned gift with NEC to become a member.

Meet Our Donors

Each and every day donors to NEC are contributing to our mission and helping our institution make a lasting impact on students' lives.

What You Can Give

Planned Gifts can have a significant impact on New England Conservatory, while also allowing you to maintain control and flexibility of your financial resources.

Ways to Give

Whether through a bequest, naming us in your assets, life income gifts, charitable lead trust or retained life estates, choose the best way to make your planned gift.

Compare and Calculate Gifts

Giving to New England Conservatory is easy when you know what's available. Use our interactive chart and calculator to help you compare, contrast, and understand all the gift types and asset classes available.

Advisor Resources

We welcome the opportunity to work with advisors working with clients who are considering a planned gift or bequest to New England Conservatory.

Additional Giving Options

By making a planned gift, you can strengthen NEC and gain financial and tax benefits for you and your family. For more information, please contact Aaron McGarry, Planned Giving Officer, by email or by phone at 617-585-1356.

Real estate can be contributed as an outright gift or to finance a planned gift. Available options include a retained life estate, which allows the donor to continue to use the property for a certain number of years, or for the donor’s lifetime. Other arrangements offer special tax advantages and lifetime income.

Gifts of real estate include undeveloped land, a residence, a vacation home, a farm, or commercial property. NEC requires the donor to bear certain costs when making a real estate gift, such as an appraisal to determine the fair market value. Also, NEC deducts transaction costs from the proceeds of the sale of the property, including the closing costs, title insurance, a survey (if needed), and any taxes due before the gift is completed.

For any questions about gifts of real estate, please contact Abigail Smitka, Assistant Vice President of Major Gifts and Campaigns, at as3628@necmusic.edu or (617) 585-1719.

Many companies support the philanthropic interests of their employees by matching employee contributions to nonprofit organizations like NEC. If your employer offers a matching gift program, you may be able to double or even triple your gift!

For more information on matching gift contributions, please contact Cheryl Fries, Assistant Director of Advancement Operations, at cheryl.fries@necmusic.edu or (617) 585-1373.

Gifts of personal property, such as musical instruments, recordings, and scores provide valuable support for our music education programs. Through the support of in-kind gifts, you can help NEC meet the college’s ongoing need to expand its inventory — and you qualify for a tax deduction.

NEC accepts in-kind donations on a case-by-case basis. For more information, please contact Patricia Kopko, Director of Advancement Operations, by email or phone at 617-585-1225

Friends of NEC may elect to make gifts to commemorate a loved one’s life, birthday, anniversary, or other special occasion. We will gladly notify those you wish to know of any gifts made in their honor.

Contributions in any amount may be directed to The NEC Fund, or to the area of your choice. Please note the name of the person you wish to commemorate when you make your gift.

Contact Us

To learn more about how you can support NEC, please contact Cheryl Fries, Assistant Director of Advancement Operations, at cheryl.fries@necmusic.edu or (617) 585-1373.

New England Conservatory is a 501(c)3 non-profit organization. All donations are tax deductible to the full extent of the law. Our non-profit tax ID is 23-7225104.

Contact Us